Maintenance > Human Resources > Employee Attributes > Accrual Plans > (New/![]() ) > Profiles Tab > (New/

) > Profiles Tab > (New/![]() ) > Rules Sets Tab > (New/

) > Rules Sets Tab > (New/![]() )

)

The Rule Set Entry page contains three tabs of data:

So that you do not need to set up earn steps each year, use the grid on this tab to set up earn steps only for those years when the accrual calculation changes.

The grid is sorted by standard, non-anniversary accrual earn steps, followed by anniversary calculation earn steps.

A rule set may contain an unlimited number of earn steps.

When adding or editing an earn step, click directly in a grid cell to enable it for entry. The grid always will provide a blank row at the bottom for adding an earn step. When you <Tab> off the last cell of the grid, a new blank row will be added to the bottom.

Note:

| Column | Description |

|---|---|

| Anniversary Calculation |

Identifies the calculation type: Annually, Quarterly or Semi-Annually. Click in the cell to enable it, and click again to select the calculation from a drop-down. Months may not overlap for earn steps within the same anniversary or non-anniversary calculation type. |

| Anniversary Date Type |

Date when accrual is calculated. The available selections are Accrual Date, Benefit Date, Hire Date and Seniority Date. Click in the cell to enable it, and click again to select the date type from a drop-down. This cell is disabled until an Anniversary Calculation is selected. |

| Step Minimum (Months) | Minimum number of months before an employee may earn the number of accrual hours at this step. Click in the cell to enable it, and type directly in the cell. |

| Step Maximum (Months) | Maximum number of months at this step before an employee may earn the number of accrual hours at the next step. Click in the cell to enable it, and type directly in the cell. |

| Hours Earned | Accrual hours earned at this step. Click in the cell to enable it, and type directly in the cell. |

To delete an earn step, click the delete icon ![]() , located in the far-left cell of the corresponding row.

, located in the far-left cell of the corresponding row.

To see what a button does, click its image below:

To accommodate accrual agreements where employees are required to work a minimum number of hours per pay period before they are eligible to earn hours for a particular accrual category, a Minimum Hours field is available at the bottom of the page.

The entry will be formatted automatically to contain four decimal places.

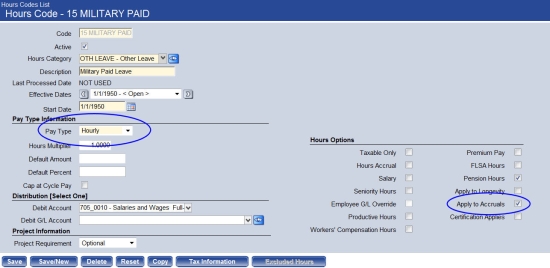

The minimum number of hours worked is determined by any hours code with a Pay Type of Hourly and the Apply to Accruals box checked. Show me.

Maintenance > Human Resources > Earnings Maintenance > Hours Codes > Hours Code:

Use this tab if accrual hours in excess of a specified maximum number need to be split and distributed to other accrual profiles, such as sick and vacation.

The grid on this tab contains the excess distribution steps that have been set up for the selected profile.

When adding or editing a step, click directly in a grid cell to enable it for entry. The grid always will provide a blank row at the bottom for adding a step. When you <Tab> off the last cell of the grid, a new blank row will be added to the bottom.

| Column | Description |

|---|---|

| Step Minimum (Months) |

Length of time employee has been with the organization. |

| Step Maximum (Months) | |

| Hours Earned Maximum Balance |

Most accrual hours an employee at the corresponding step may have in bank. This number is a balance restriction that ignores the year or carryover situation. An entry in this cell enables the fields in the Hours Earned Maximum Overflow Distribution section located directly below the grid. |

| YTD Hours Earned Maximum |

Most accrual hours an employee may earn in one year for a given profile. Along with this number and the step month, the plan calculation percentage associated with an employee will be used to arrive at the actual YTD Hours Earned Maximum. To determine the start date of the one-year period being covered in the year-to-date maximum, navigate to Maintenance > Human Resources > Earnings Maintenance > Hours Categories, select the corresponding accrual hours category, and select the Roll Date. |

| Roll Hours Cap | Limits the number of hours that may be carried over from one year to the next. |

To delete a step, click the delete icon ![]() , located in the far-left cell of the corresponding row.

, located in the far-left cell of the corresponding row.

Note: A step that has been used in a payroll cannot be deleted.

To see what a button does, click its image below:

Note: Until data is entered in at least one row of the grid, the fields below the grid are blank and disabled.

| Field | Description |

|---|---|

|

Hours Earned Maximum Overflow Distribution The fields in this section are enabled when the Hours Earned Maximum Balance column of the grid contains at least one entry. |

|

| Lost/Paid Hours Code |

Required if enabled. Identifies the hours code where the lost or paid hours will go. The available lost hours codes are those with multipliers of zero (0). This hours code and the accrual plan must reside within the same accrual category, and the Accruals Earned box may not be checked on the hours code. |

| Overflow Hours Code |

Enabled if the Hours Earned Maximum Balance column of the grid contains an entry, identifies the hours code where overflow hours will be distributed at a designated percentage. This hours code and the accrual plan must reside in different accrual categories, and the Accruals Earned box needs to be checked on the hours code. When overflow hours are distributed to alternate hours codes, the accrual profiles and rule sets for those hours codes make sure the hours being added to those accrual banks do not exceed the maximums defined. If the profile of the Overflow Hours Code has a maximum balance and overflow hours codes defined, the overflow hours codes cannot match the hours code set up on the original profile that was selected on the Calculate Accrual Hours page. If the overflow hours codes do not have a corresponding profile with the plan, the hours simply will be applied to those hours codes. |

| Allow Split |

Determines whether excess hours will be distributed to different hours codes. Checking this box enables the fields located directly below it and requires an entry in the Overflow Hours Code field. |

| Ignore YTD Hours Earned Max |

Select to have the full number of excess hours from an accrual calculation roll into the accrual profile selected in the Overflow Hours Code field, regardless of the maximum year-to-date hours limit set up on the profile. |

| Percentage to Primary |

Enabled and required if Allow Split is checked, tells the percentage of the excess hours to be distributed to the primary Overflow Hours Code. This entry may not exceed 100%. |

| Secondary Hours Code | Enabled and required if Allow Split is checked, tells the percentage of the excess hours to be distributed to the secondary hours code after the primary hours code has reached its quota of excess hours. |

| Allow Override of Hours Earned Maximum Balance |

Accommodates scenarios where the maximum balance is reached and a percentage is rolled to another hours code, but the remainder continues to accrue against the current hours code. For example, if the first step of a vacation accrual rule set is 0 to 23 months and the Hours Earned Maximum Balance is 8 hours, checking this box gives you the ability to allow hours earned in excess of 8 to be divided between two hours codes, such as vacation and sick. If this box is unchecked, the current hours code of the rule set will not show in the primary or secondary hours codes boxes. |

|

Roll Hours Transfer Distribution The fields in this section are enabled when the Roll Hours Cap column of the grid contains at least one entry. "Roll hours" refers to the practice of rolling hours earned in excess of the maximum into a different accrual bank. |

|

| Lost/Paid Hours Code |

Required if enabled. Identifies the hours code where the lost or paid hours will go. The available lost hours codes are those with multipliers of zero (0). This hours code and the accrual plan must reside within the same accrual category, and the Accruals Earned box may not be checked on the hours code. |

| Overflow Hours Code |

Identifies the hours code where overflow hours will be rolled. This hours code and the accrual plan must reside in different accrual categories, and the Accruals Earned box needs to be checked on the hours code. |

| Allow Split |

Determines whether excess hours will be rolled to different hours codes. Checking this box enables the fields located directly below it and requires an entry in the Overflow Hours Code field. |

| Percentage to Primary | Enabled and required if Allow Split is checked, tells the percentage of the excess hours to be rolled to the primary hours code. This entry may not exceed 100%. |

| Secondary Hours Code | Enabled and required if Allow Split is checked, tells the percentage of the excess hours to be rolled to the secondary hours code. |

The grid on this tab shows the earn steps that dictate how an employee is to be paid for unused accrual time on ending his employment with the organization.

The Payoff Type selected is displayed directly above the grid.

If the Payoff Specification section of the Profile tab contains a Payoff Type selection, this grid must contain at least one step; otherwise, the Payoff Steps tab is disabled.

The payoff calculation uses the same Rounding Method selected for the Interval Taken entry in the Calculation Type section of the Profile tab.

A rule set may contain an unlimited number of payoff steps.

When adding or editing a payoff step, click directly in a grid cell to enable it for entry. The grid always will provide a blank row at the bottom for adding a step. When you <Tab> off the last cell of the grid, a new blank row will be added to the bottom.

Note:

Note:

| Column | Description |

|---|---|

| Step Minimum (Months) | Minimum number of months before an employee receives the pay out at this step. |

| Step Maximum (Months) | Maximum number of months at this step before an employee receives the pay out at the next step. |

| Payoff Hours | Accrual hours earned at this step. An entry in this cell disabled the corresponding Percent and Maximum Payoff Hours cells. |

| Percent | Percent of accrual that may be paid. An entry in this cell disables the corresponding Payoff Hours cell. |

| Maximum Payoff Hours | Most accrual hours an employee may be paid at this step. |

To delete a payoff step, click the delete icon ![]() , located in the far-left cell of the corresponding row.

, located in the far-left cell of the corresponding row.

To see what a button does, click its image below: